To track your PF, visit the official EPF website and enter your UAN and password. This will provide you with the necessary information.

Managing and tracking your PF (Provident Fund) is an essential aspect of financial planning. PF is a government-backed retirement savings scheme in India that enables employees to accumulate a significant corpus over their working years. However, keeping track of your PF can sometimes be a challenging task.

We will discuss how to track your PF conveniently and effortlessly. By following these simple steps, you will be able to effortlessly stay informed about your PF balance, contributions, and other important details. Let’s delve into the process to ensure that nothing hampers your financial goals.

Understanding The Importance Of Pf Tracking

Understanding the importance of tracking your PF is crucial for managing your financial future. Learn how to track your PF efficiently with these essential tips and tools.

Keeping track of your PF (Provident Fund) is an essential task that can greatly contribute to your financial planning. Understanding the importance of PF tracking will empower you to make informed decisions about your future. In this section, we will explore the benefits of tracking PF and why it is crucial for effective financial planning.

Benefits Of Tracking Pf:

- Retirement readiness: Monitoring your PF allows you to assess your progress towards a financially secure retirement. By tracking the growth of your PF account over time, you can determine if you are on track to meet your retirement goals.

- Financial stability: Regularly tracking your PF enables you to stay updated on your current account balance and contributions made by both you and your employer. This knowledge provides a sense of financial stability and helps you make more informed financial decisions.

- Tax planning: Tracking your PF helps you effectively plan your tax liabilities. By understanding the tax implications of PF withdrawals and contributions, you can optimize your tax savings and minimize any unnecessary tax burdens.

- Emergency fund creation: Consistently monitoring your PF can serve as a reminder to maintain an emergency fund. You can utilize a portion of your PF contributions to build an emergency corpus, providing financial security during unexpected situations.

- Loan eligibility: Tracking your PF balance can also impact your loan eligibility. A higher balance shows lenders that you have a stable financial background, potentially qualifying you for better loan options with favorable terms and interest rates.

By actively monitoring your PF, you can take advantage of these benefits and secure your financial future.

Why It Is Crucial For Financial Planning:

- Ensures accurate retirement planning: Tracking your PF helps you estimate the funds available for your retirement. This enables you to assess if you are saving enough and make any necessary adjustments to ensure a comfortable retirement.

- Facilitates goal-oriented savings: With PF tracking, you can align your financial goals and regularly monitor your progress. Whether it’s saving for a down payment on a house or higher education for your children, tracking your PF ensures you stay on track towards achieving these goals.

- Provides a comprehensive financial picture: Monitoring your PF alongside other investments gives you a holistic view of your financial standing. This allows you to make well-informed decisions based on your overall financial situation.

- Enhances financial discipline: By tracking your PF, you develop a habit of monitoring your finances consistently. This discipline extends to other aspects of your financial planning, fostering good financial habits and ensuring a more secure financial future.

Understanding the crucial role that PF tracking plays in financial planning empowers you to take control of your finances and make informed decisions to achieve your goals. So, let’s dive into the practical aspects of tracking your PF and explore how it can positively impact your financial journey.

Setting Up A Pf Tracking System

Setting up a PF tracking system is essential for efficiently monitoring your PF investments. Learn how to easily track your PF with these practical tips and ensure a well-organized financial future.

Keeping track of your PF (Provident Fund) is essential for managing your retirement savings and ensuring your financial well-being. With a few simple steps, you can set up a PF tracking system that will help you stay organized and informed about your contributions and earnings.

In this section, we will explore the process of selecting the right tracking tool and organizing your information for easy tracking.

Selecting The Right Tracking Tool:

To efficiently track your PF, it is crucial to choose a reliable tracking tool that suits your needs. Consider the following points when selecting the right tracking tool:

- User-friendly interface: Look for a tool with an intuitive and easy-to-navigate interface to ensure a seamless tracking experience.

- Compatibility: Ensure that the tracking tool is compatible with the platform you use, whether it is a desktop app, mobile application, or web-based software.

- Features: Opt for a tool that offers comprehensive features such as real-time updates, automatic calculations, and customizable reports to meet your specific tracking requirements.

- Security: Prioritize data security by selecting a tracking tool that employs robust encryption protocols and safeguards your personal information.

Organizing Your Information For Easy Tracking:

Once you have chosen the right tracking tool, it is essential to organize your PF information effectively. Here are some tips to make tracking your PF easier and more efficient:

- Gather your documents: Collect all the relevant documents, such as your PF account statements, contribution receipts, and employer correspondence, in one place.

- Create a filing system: Organize your physical and digital documents in a structured manner. Consider using folders or labels to categorize your documents by year, employer, and account number.

- Maintain a spreadsheet: Create a spreadsheet using tools like Microsoft Excel or Google Sheets to record your PF contributions, withdrawals, and interest earnings. Include columns for date, transaction type, amount, and remarks. This will enable you to have a clear overview of your PF transactions.

- Set reminders: To ensure timely contributions, set reminders for yourself regarding submission dates and other important milestones related to your PF. This will help you stay on top of your contributions and avoid any penalties.

- Regularly update your tracking system: Make it a habit to update your tracking tool or spreadsheet regularly, preferably after each PF transaction. This will ensure that you have accurate and up-to-date information at all times.

By selecting the right tracking tool and organizing your information systematically, you can establish an effective PF tracking system. This will empower you to remain informed about your PF contributions and make well-informed decisions regarding your retirement savings. So, get started on setting up your PF tracking system today and take control of your financial future.

Tracking Pf Contributions And Withdrawals

Track your PF contributions and withdrawals with ease using these simple steps. Stay updated on your PF balance effortlessly.

When it comes to managing your Provident Fund (PF), tracking your contributions and withdrawals is crucial. This ensures that you have a clear record of your financial transactions and can easily monitor the growth of your PF account. Let’s delve into the details of how you can effectively track your PF contributions and withdrawals.

Recording Monthly Contributions

To keep track of your monthly contributions, it’s essential to maintain accurate records. Here’s how you can do it:

- Create a dedicated spreadsheet or use accounting software to record your monthly contributions.

- Include details such as the date of contribution, the amount deposited, and the source (employee or employer contribution).

- Regularly update the spreadsheet to ensure it reflects the most recent transactions.

- Double-check the accuracy of the data input to avoid any discrepancies.

Remember, maintaining a record of your monthly contributions helps you gauge the growth of your PF account over time and enables you to calculate your returns accurately.

Monitoring Pf Withdrawal Transactions

As you plan for your financial goals, there might be instances where you need to withdraw from your PF account. To effectively track your PF withdrawals, consider the following:

- Keep a record of all withdrawal requests submitted, noting the purpose and date of each request.

- Monitor the status of your withdrawal requests by regularly checking online portals or contacting the concerned authorities.

- Track the amount withdrawn and ensure it matches the approved withdrawal amount.

- Update your PF account records to reflect the withdrawal and maintain accurate information.

By effectively monitoring your PF withdrawal transactions, you can stay informed about the utilization of your funds and ensure that everything is in order.

Tracking your PF contributions and withdrawals is essential for managing your Provident Fund effectively. By recording monthly contributions and monitoring withdrawal transactions, you can have a clear understanding of your financial transactions and make better-informed decisions. So, take control of your PF account and keep a close eye on your contributions and withdrawals for a secure financial future.

Analyzing Pf Performance

Learn how to effectively track and analyze your PF performance with these simple strategies. From monitoring your progress to identifying areas for improvement, you’ll gain valuable insights to optimize your performance and achieve your goals.

Analyzing the performance of your investment portfolio (PF) is crucial in understanding its overall effectiveness in meeting your financial goals. By evaluating investment returns and comparing PF performance with benchmarks, you can gain valuable insights into the success of your investment strategy.

Let’s dive into these two essential aspects of analyzing PF performance:

Evaluating Investment Returns

To measure the success of your investments, evaluating investment returns is essential. This process allows you to assess how well your PF has performed over a specific period. Consider these key factors when evaluating investment returns:

- Returns over time: Calculate the returns of your PF over different time periods, such as monthly, quarterly, or annually. This information helps you identify trends and fluctuations in performance.

- Absolute return: The absolute return measures the overall gain or loss of your PF. It provides you with a clear picture of the profitability of your investments.

- Risk-adjusted return: Evaluating the risk-adjusted return accounts for the level of risk taken to achieve the returns. It considers the volatility of your investments, ensuring that you are adequately compensated for the risks involved.

Comparing Pf Performance With Benchmarks

Comparing the performance of your PF with benchmarks allows you to assess how well your investments have fared in comparison to the market as a whole. Here’s why benchmark comparison is crucial:

- Relative performance: Comparing your PF’s performance against a benchmark provides insights into whether your investments have outperformed or underperformed the market. It helps you gauge your investment strategy’s success relative to the broader market.

- Identifying strengths and weaknesses: Benchmark comparison enables you to identify which areas of your PF are performing well and which may require adjustments. It helps you determine if any specific sectors or assets contribute significantly to your PF’s performance.

- Portfolio rebalancing: If your PF consistently underperforms the benchmark, it may be an indicator that you need to rebalance your portfolio. Rebalancing ensures that your investments are aligned with your desired asset allocation and risk tolerance.

By regularly evaluating investment returns and comparing your PF’s performance with benchmarks, you can make well-informed decisions to optimize your investment strategy. Monitoring and analyzing these key aspects provide the necessary insights to adjust your portfolio and work towards achieving your financial goals.

Utilizing Automation For Pf Tracking

Track your PF effortlessly with the power of automation. Streamline the process and save time in managing your PF accounts effectively.

Using Apps And Software For Automated Tracking

In today’s fast-paced world, manual tracking of your provident fund (PF) can be time-consuming and prone to errors. Thankfully, there are several user-friendly apps and software available that can automate your PF tracking process. By leveraging automation, you can effortlessly stay up to date with your contributions, withdrawals, and overall PF balance.

Here are some effective ways to utilize apps and software for automated PF tracking:

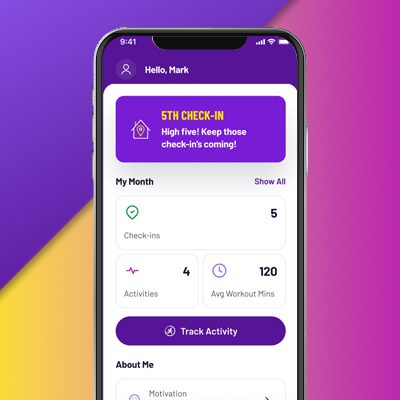

- Mobile Apps: With the advent of mobile technology, managing your PF has become easier than ever. There are numerous mobile apps specifically designed to track and manage your PF details. These apps allow you to input your relevant information and provide real-time updates on your PF balance. Some even offer additional features such as personalized financial advice and investment options.

- Web-based Tracking Tools: Online platforms and web-based tracking tools provide a convenient way to automate your PF tracking. These tools typically require you to sign up and enter your PF details. Once set up, they will automatically fetch and update your PF balance, contribution history, and other important information in a secure and organized manner.

- Integration with Payroll Systems: Many modern payroll systems come with built-in PF tracking features. These systems automatically calculate the PF contributions for both employees and employers, making the tracking process seamless. With integration, you can ensure that your PF contributions are accurately reflected in your payroll records, avoiding any discrepancies or missed payments.

- Reminder and Alert Features: Automation not only simplifies tracking but also helps you stay on top of important deadlines and updates. Apps and software often offer reminder and alert features that can notify you about upcoming PF contribution due dates, interest rate changes, or any other relevant updates. Setting up these reminders and alerts ensures you never miss important milestones or deadlines.

- Document Management: Some PF tracking apps and software also provide document management capabilities. You can securely store all your PF-related documents, such as contribution receipts, withdrawal forms, and nomination files, in a centralized digital repository. This feature simplifies document retrieval and ensures that you have all the necessary paperwork readily available whenever needed.

Automating your PF tracking process using apps and software offers numerous advantages over manual methods. It saves time, minimizes errors, and keeps you well-informed about your PF status. By effectively leveraging automation, you can effortlessly manage your PF and focus on other important aspects of your financial journey.

So, why not take advantage of these innovative tools and streamline your PF tracking today?

Tracking Pf For Tax Purposes

To track your PF for tax purposes, maintain accurate records of your contributions and withdrawals. Use a spreadsheet or online platform to monitor your PF transactions and ensure compliance with tax regulations.

When it comes to managing your PF account, it’s crucial to be aware of the tax implications associated with your transactions. By understanding the tax rules and documenting your PF-related deductions properly, you can optimize your tax savings. Here’s a breakdown of how to track PF for tax purposes:

Understanding Tax Implications Of Pf Transactions:

- Withdrawals: Any amount withdrawn from your PF account before completing 5 years of continuous service is subject to tax, unless specific conditions apply. The amount withdrawn is classified as taxable income and must be included in your annual tax return.

- Interest income: The interest earned on your PF contributions is taxable if you withdraw the amount within 5 years of opening the account. However, interest income is exempt from tax if the withdrawal is made after 5 years.

Documenting Pf-Related Tax Deductions:

- Employee contribution: Your contributions made towards the PF account are eligible for tax deductions under Section 80C of the Income Tax Act. Ensure you maintain the necessary documents and receipts to claim this deduction while filing your tax return.

- Employer contribution: Although your employer’s contribution to the PF account doesn’t qualify for individual tax deductions, it is exempt from tax under Section 10(11) of the Income Tax Act. It’s essential to verify that your employer reflects the correct contribution amount in your Form 16 (provided by employers for tax purposes).

- Voluntary contributions: Sometimes, individuals contribute more than the mandatory percentage of their salary to their PF account. You can claim tax deductions up to a maximum specified limit for these voluntary contributions under Section 80C.

- PF transfer: If you switch jobs and transfer your PF balance to a new account, there are no tax implications. It’s important to maintain proper documentation of the transfer process for future reference and to ensure accuracy in tax calculations.

- Tax-exempt withdrawals: There are certain situations where PF withdrawals are exempt from tax, such as under specific circumstances like severe illness, disablement, or discontinuation of the employer’s business. Ensure you meet the required conditions and provide the necessary documentation to avail of these exemptions.

Understanding the tax implications of your PF transactions and documenting PF-related tax deductions accurately can streamline your tax planning. By adhering to the guidelines and keeping proper records, you can maximize your tax savings while staying compliant with tax regulations.

Common Challenges In Pf Tracking

Track Pf effectively by overcoming common challenges in PF tracking. Gain insights and manage employee provident fund effortlessly with streamlined tracking solutions.

Dealing With Missing Or Incorrect Data:

When it comes to tracking your PF, one of the common challenges you may face is dealing with missing or incorrect data. It can be frustrating and time-consuming, but with the right strategies, you can overcome these obstacles. Here’s how to handle such situations effectively:

- Double-check the information: Before jumping to conclusions, make sure to verify the data you have. Cross-reference it with official documents or reach out to relevant authorities to ensure accuracy.

- Communicate with your employer: If you notice any discrepancies or missing information in your PF statement, don’t hesitate to get in touch with your employer’s HR department. They can assist you in resolving the issue and provide the necessary clarification.

- Keep records of your own contributions: It’s a good practice to maintain your own records of PF contributions, including payslips, account statements, and any other relevant documents. This way, you can compare them with the statements received from your employer and identify any discrepancies.

- Contact the PF department: In case you encounter persistent issues and are unable to resolve them with your employer, reach out to the PF department directly. Provide them with all the necessary details and documentation to help them investigate and rectify any errors or missing information.

- Seek professional assistance if needed: If the problem persists or becomes too complex to handle on your own, consider consulting with a financial advisor or PF expert. They can offer guidance, review your documents thoroughly, and assist you in navigating through the process.

Remember, dealing with missing or incorrect data in PF tracking may require patience and persistence. By following these steps, you can effectively address these challenges and ensure the accuracy of your PF records. Now, let’s move on to the next common difficulty in PF tracking—handling inconsistencies in PF statements.

Credit: www.youtube.com

Tips For Streamlining Pf Tracking

Learn how to effectively track your PF and streamline the process with these expert tips. Take advantage of simple and efficient methods to stay organized and ensure accurate tracking of your PF.

Creating A Streamlined Tracking Process:

Keeping track of employees’ provident fund (PF) can be a tedious task for any organization. However, with a streamlined tracking process in place, managing PF becomes much simpler and more efficient. Here are some tips to help you streamline your PF tracking:

- Automate Your Tracking System: Utilize technology to automate your PF tracking process. This can be achieved by using PF management software or payroll systems that have built-in PF tracking capabilities. Automation eliminates manual errors and saves time by automatically calculating and updating PF contributions.

- Maintain Accurate Employee Records: Ensure that you have accurate and up-to-date employee records, including essential information such as employee names, PF numbers, and contribution details. This will make it easier to track and reconcile PF accounts accurately.

- Implement a Centralized System: Create a centralized system, whether it’s a physical or digital filing system, to store all PF-related documents and records. This ensures easy accessibility and prevents any loss of important documents.

- Establish Clear Communication: Open and transparent communication with employees about their PF contributions is essential. Clearly communicate the process, rules, and timelines for PF contributions to avoid any confusion or discrepancies.

- Regularly Review and Reconcile PF Accounts: Regularly review and reconcile PF accounts to identify any discrepancies or errors. This includes cross-checking the PF contributions made by employees and employers against the records maintained.

- Stay Up-to-Date with PF Regulations: Keep yourself informed about the latest PF regulations and amendments. This helps ensure compliance and prevents any legal issues related to PF tracking.

- Monitor PF Compliance: Regularly monitor PF compliance within the organization. This includes verifying that all eligible employees are enrolled in the PF scheme and that contributions are being made correctly.

- Train and Educate HR Personnel: Provide proper training and education to HR personnel responsible for PF tracking. This ensures that they have a clear understanding of the process and are equipped to handle any PF-related queries or issues efficiently.

- Use Standardized Templates: Utilize pre-designed templates for tracking and maintaining PF records. Standardized templates help maintain consistency and reduce the chances of errors during data entry.

- Conduct Periodic Audits: Conduct periodic audits of your PF tracking process to identify any areas that need improvement or optimization. Audits help identify inefficiencies and allow for timely corrective actions.

By implementing these tips, you can streamline your PF tracking process, making it more accurate, efficient, and hassle-free for your organization and employees.

Ensuring Compliance And Security In Pf Tracking

Track Pf effectively to ensure compliance and security with our reliable system. Stay on top of your Pf tracking needs effortlessly.

In today’s digital age, tracking PF (Personal Finance) has become essential to keep a tab on our financial health. However, it is crucial to prioritize compliance and security when it comes to managing personal information. In this section, we will explore the best practices to protect personal information in tracking systems and staying updated with PF regulations and rules.

Protecting Personal Information In Tracking Systems:

- Encrypt the personal financial data: By using strong encryption techniques, you can ensure that personal information remains secure and protected from unauthorized access.

- Implement access controls: Control who has access to PF tracking systems by using user authentication methods and role-based access controls. This limits the exposure of sensitive information.

- Regularly monitor and update systems: Keep track of security vulnerabilities and apply relevant updates to the tracking systems to ensure protection against potential threats.

- Use anonymized data where possible: When analyzing PF data, anonymize personal information to prevent individuals from being identified. This protects their privacy while still allowing for useful insights and analysis.

Staying Updated With Pf Regulations And Rules:

- Familiarize yourself with data protection laws: Stay informed about applicable data protection laws and regulations to ensure compliance with legal requirements when handling personal information.

- Follow industry best practices: Keep up-to-date with the best practices relevant to PF tracking and incorporate them into your processes. This includes understanding data retention policies and secure data disposal methods.

- Conduct regular internal audits: Periodically review your PF tracking systems and processes to check for compliance. Identify any areas that need improvement and take necessary action to align with regulations.

- Educate employees: Provide training to your team about PF regulations and security practices. This ensures that everyone involved in PF tracking understands their responsibilities and follows best practices.

- Stay informed about regulatory updates: Keep an eye on any updates or changes in PF regulations and rules. This helps you stay ahead of any new compliance requirements and maintain the highest level of security.

By implementing these measures and staying proactive in compliance and security, you can confidently track your PF while safeguarding personal information. Remember, protecting privacy and keeping up with regulations should always be a priority to ensure a secure and compliant PF tracking process.

Frequently Asked Questions Of How To Track Pf

How Can I Track My Pf By Tracking Id?

To track your PF using the tracking ID, follow these steps: 1. Visit the official PF website. 2. Enter your tracking ID in the designated field. 3. Click on the “Track” button. 4. You’ll be able to view the current status of your PF.

How Can I Check My Pf Transfer?

To check your PF transfer, visit the official website and log in to your account. Look for a section on transfer status or contact customer support for assistance.

Why Is My Pf Claim Taking So Long?

Your PF claim may be taking longer due to documentation issues or a backlog at the PF office.

How Long Does It Take For Pf Claim To Settle?

The time it takes for a PF claim to settle varies and depends on several factors.

Conclusion

Tracking your PF (personal finance) is essential for taking control of your financial future. By monitoring your expenses, setting financial goals, and regularly reviewing your budget, you can make informed decisions that align with your long-term objectives. Keep in mind that tracking your PF is a continuous process that requires dedication and discipline.

Embrace the tools and technology available, such as budgeting apps or spreadsheets, to simplify the process and stay organized. Remember to regularly evaluate and adjust your strategies as your financial situation evolves. By consistently tracking your PF, you will gain a deeper understanding of your spending habits, identify areas for improvement, and ultimately achieve financial stability and success.

Start tracking your PF today and pave the way for a brighter financial future.

- What Is the 11 Hour Limit: A Comprehensive Guide - June 7, 2024

- What Happens if You Drive on a Suspended License in Virginia - June 7, 2024

- Wilcox Justice Court Overview: Online Services & Legal Proceedings - June 6, 2024