To track your PNC debit card, go to the PNC website and log in to your account. Then, navigate to the “Account Activity” or “Transaction History” section, where you can view your recent debit card transactions and track your card activity.

Monitoring your PNC debit card is easy and convenient with online banking. In today’s fast-paced digital world, staying on top of your finances has become more important than ever. One essential aspect of managing your finances is ensuring the security and accuracy of your debit card transactions.

With the convenience of online banking, tracking your PNC debit card has never been easier. By simply logging into your PNC account and accessing the “Account Activity” or “Transaction History” section, you can effortlessly monitor your card activity, review recent transactions, and keep a close eye on your finances. We will discuss the step-by-step process of tracking your PNC debit card transactions and provide insights on how to effectively manage your financial activities.

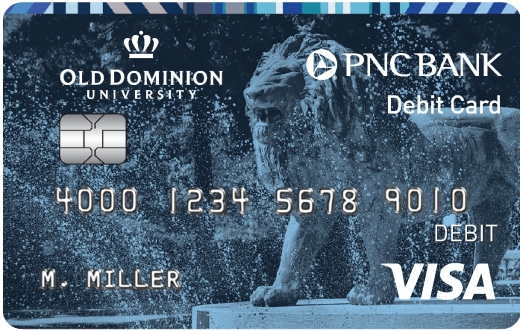

Credit: www.odu.edu

Understanding The Pnc Debit Card Tracking Process

Track your PNC debit card effortlessly with the easy-to-understand tracking process. Stay in control of your finances and monitor your card activity anytime.

Have you ever wondered how to keep a close eye on your Pnc debit card transactions? Understanding the tracking process can be incredibly beneficial, giving you the peace of mind and control over your finances that you deserve. In this section, we will delve into the importance of tracking your Pnc debit card transactions and explore the benefits of monitoring your Pnc debit card activity.

Importance Of Tracking Your Pnc Debit Card Transactions:

- Identifying fraudulent activity: By tracking your Pnc debit card transactions regularly, you can quickly spot any suspicious or unauthorized charges. This allows you to take immediate action and prevent potential financial losses.

- Managing your budget: Tracking your Pnc debit card transactions helps you keep a pulse on your spending habits. It allows you to review and analyze your expenses, making it easier to set budgeting goals and make informed financial decisions.

- Detecting errors: Every once in a while, mistakes can occur in your Pnc debit card transactions, such as double charges or incorrect amounts. By diligently tracking your transactions, you can detect these errors and rectify them with ease.

- Building good financial habits: Tracking your Pnc debit card transactions fosters a sense of financial responsibility and accountability. It encourages you to be more mindful of your spending, promoting healthy financial habits in the long run.

- Enhancing financial security: Regularly monitoring your Pnc debit card activity acts as an additional layer of security for your finances. It allows you to be proactive in protecting your information and mitigating any potential risks.

Benefits Of Monitoring Your Pnc Debit Card Activity:

- Real-time transaction updates: By monitoring your Pnc debit card activity, you can stay updated on your transactions in real-time. This helps you stay informed about how and where your money is being spent.

- Quick dispute resolution: In the unfortunate event that you encounter a disputed or incorrect charge on your Pnc debit card, monitoring your activity enables you to take prompt action. It provides you with the necessary information to dispute the charge efficiently.

- Financial goal tracking: Monitoring your Pnc debit card activity provides valuable insights into your spending patterns, allowing you to track your progress towards financial goals. Whether you’re saving for a vacation or paying off debt, tracking your activity helps you stay on track.

- Improved financial organization: Regularly monitoring your Pnc debit card activity ensures that you stay organized with your finances. It allows you to easily reconcile your transactions, maintain accurate records, and stay in control of your money.

- Peace of mind: By actively monitoring your Pnc debit card activity, you can enjoy the peace of mind that comes with knowing your finances are secure. It eliminates the worry of any potential unauthorized transactions going unnoticed and safeguards your financial well-being.

Understanding the Pnc debit card tracking process empowers you to take control of your financial life. By recognizing the importance of tracking your Pnc debit card transactions and embracing the benefits of monitoring your activity, you can achieve greater financial security, make informed decisions, and build a solid foundation for your future.

Setting Up Online Banking For Pnc Debit Card Tracking

Setting up online banking for PNC debit card tracking is a convenient way to monitor your transactions and manage your finances. Easily track your PNC debit card activity and stay on top of your financial health with online banking.

How To Track Pnc Debit Card:

Setting up online banking for tracking your Pnc debit card transactions is a convenient and secure way to stay on top of your finances. With the Pnc online banking platform, you can easily monitor your spending, view account balances, and receive alerts for any suspicious activity.

Follow this step-by-step guide to create an online banking account and link your Pnc debit card for seamless tracking:

Step-By-Step Guide To Create An Online Banking Account:

Creating an online banking account with Pnc is a straightforward process that can be done in a few simple steps:

- Visit the Pnc Bank website: Start by going to the official Pnc Bank website using your preferred web browser.

- Click on “Enroll in Online Banking”: Look for the option to enroll in online banking, usually located prominently on the homepage. Click on it to begin the enrollment process.

- Provide your personal information: Fill in the required fields with accurate information, including your full name, Social Security number, date of birth, and email address. Be sure to double-check your details for accuracy.

- Set up your login credentials: Create a unique username and password that you will use to access your online banking account. Ensure your password is strong and secure by combining letters, numbers, and special characters.

- Verify your identity: As an added layer of security, Pnc may require you to verify your identity during the enrollment process. This could involve answering security questions or providing verification codes sent to your registered email address or phone number.

- Review and accept terms of service: Carefully read through the terms of service and privacy policy before accepting them. It’s important to be aware of your rights and responsibilities as an online banking user.

- Complete enrollment: Once you have entered all the necessary information and accepted the terms, submit your enrollment application. Pnc will then process your request and send you a confirmation email to notify you of a successful enrollment.

Linking Your Pnc Debit Card To The Online Banking Platform:

After creating your online banking account, the next step is to link your Pnc debit card for comprehensive tracking of your transactions. Here’s how you can do it:

- Log in to your online banking account: Use the username and password you created during the enrollment process to log in to your online banking account.

- Navigate to the “Account Services” section: Look for the “Account Services” tab or section in your online banking dashboard. This is where you can manage various aspects of your Pnc account.

- Select “Link a Debit Card”: Within the “Account Services” section, find the option to link a debit card and click on it.

- Enter your debit card details: Provide the required information for your Pnc debit card, including the card number, expiration date, and the name associated with the card. Double-check the accuracy of the entered details before proceeding.

- Verify your card: To ensure that you are the rightful owner of the debit card, Pnc may ask you to verify ownership through a verification code sent to your registered mobile number or email address. Enter the code when prompted to complete the verification process.

- Confirm the link: Once the verification process is complete, Pnc will confirm the successful linking of your debit card to your online banking account. You can now access comprehensive transaction details and track your Pnc debit card activity online.

By following these simple steps, you can set up your online banking account and link your Pnc debit card for convenient tracking. Take advantage of Pnc’s online banking platform to stay informed about your spending habits, detect any unauthorized transactions, and manage your finances with ease.

Monitoring Pnc Debit Card Transactions

Easily track your PNC debit card transactions with convenient monitoring tools. Stay in control of your finances by keeping an eye on your spending and detecting any suspicious activity.

Accessing Your Online Banking Dashboard

To track your PNC debit card transactions, you can easily access your online banking dashboard. It provides a convenient way to monitor your account activity and keep tabs on any transactions made with your debit card. Here’s how you can get started:

- Log in to your PNC online banking account using your username and password.

- Once logged in, navigate to the “Account Overview” or “Account Summary” section.

- Look for the section specifically dedicated to your debit card or transaction history.

- Click on the link or tab that allows you to view your recent transactions.

Viewing Recent Transactions And Transaction History

Once you have accessed your online banking dashboard, you can view your recent transactions and transaction history. This helps you keep track of your spending and identify any unauthorized transactions. Here are some ways you can view this information:

- On your online banking dashboard, you will find a list of your recent transactions. This typically includes the date, time, merchant name, and transaction amount.

- If you want to delve deeper into your transaction history, look for an option to view the full transaction history or a specific time range.

- Sort the transactions by date, amount, or merchant name to make it easier to identify specific transactions.

Tips for identifying unauthorized transactions:

- Regularly review your transaction history to spot any unfamiliar or suspicious transactions.

- Pay attention to small or recurring transactions that may indicate fraudulent activity.

- If you notice any unauthorized transactions, report them immediately to PNC customer service.

- Enable transaction alerts or notifications through your online banking settings. This way, you’ll receive instant alerts for any transactions made with your debit card.

By accessing your online banking dashboard and viewing your transaction history, you can easily monitor your PNC debit card transactions. Take advantage of these tools to stay on top of your finances and ensure the security of your account.

Enabling Notifications For Pnc Debit Card Activity

To track your PNC debit card activity, enable notifications that provide real-time updates on your transactions. Stay informed and in control of your financial transactions effortlessly.

Managing and tracking your Pnc Debit Card activity is an essential part of maintaining control over your finances. Enabling notifications for your Pnc Debit Card ensures that you receive timely updates and alerts about your transaction activity. This allows you to stay on top of your spending and identify any unauthorized or suspicious charges quickly.

Here is a step-by-step guide on customizing notification settings for alerts and updates, as well as setting up email or text message notifications for transaction activity.

Customizing Notification Settings For Alerts And Updates:

- Log in to your Pnc online banking account and navigate to the “Account Services” section.

- Select “Manage Alerts” to access the notification settings for your Pnc Debit Card.

- Review the available options for alerts and updates and choose the ones that are most relevant to your needs. Options may include:

- Low Balance Alert: Receive a notification when your Pnc Debit Card balance falls below a certain threshold.

- Large Purchase Alert: Get an alert when a transaction above a specified amount is made with your Pnc Debit Card.

- International Transaction Alert: Be notified whenever your Pnc Debit Card is used for an overseas transaction.

- Declined Transaction Alert: Receive an alert if a transaction with your Pnc Debit Card is declined.

- Once you have selected the desired notification options, save your changes to apply the customized settings.

Setting Up Email Or Text Message Notifications For Transaction Activity:

- In the “Manage Alerts” section, choose whether you prefer to receive notifications via email or text message.

- If you select email notifications, make sure your email address is up to date and accurately entered in your Pnc online banking account.

- For text message notifications, enter your mobile phone number and carrier information. Verify that this information is correct and working.

- Select the specific types of transaction activities for which you want to receive notifications. This could include purchases, ATM withdrawals, or any other transaction category applicable to your Pnc Debit Card.

- Save your changes to activate the email or text message notifications for transaction activity.

By customizing your Pnc Debit Card notification settings and enabling email or text message alerts, you can effectively track and monitor your card activity. This proactive approach empowers you to take quick action in case of any unauthorized or unexpected transactions.

Stay in control of your financial life with the convenience of Pnc Debit Card notifications.

Using Mobile Apps For Pnc Debit Card Tracking

Track and manage your PNC debit card transactions with ease using mobile apps. Stay updated on your account balance, view transaction history, and receive instant notifications, all at your fingertips. Simplify your banking experience with PNC’s convenient and user-friendly mobile apps.

Overview Of Pnc Mobile Banking App Features

The Pnc mobile banking app provides a range of features that allow you to conveniently track your debit card transactions on the go. Here is an overview of some of the key features available:

- Mobile Check Deposit: Easily deposit checks by taking a photo within the app, eliminating the need to visit a physical branch.

- Balance Inquiry: Check your account balance at any time to stay on top of your finances.

- Transaction History: View your recent transaction history, including debit card purchases and withdrawals, in real-time.

- Alerts and Notifications: Set up personalized alerts to receive notifications for various account activities, such as a large purchase or low balance.

- Budgeting Tools: Access budgeting tools that help you track your spending habits and manage your finances more effectively.

Tracking Your Debit Card Transactions On The Go

With the Pnc mobile banking app, keeping track of your debit card transactions has never been easier. Here’s how you can stay updated on your spending and account activity:

- Real-time Transaction Updates: Get instant updates on your debit card transactions as they happen, ensuring you have an accurate picture of your spending.

- Search and Filter Options: Easily search and filter your transaction history to find specific purchases or withdrawals, making it simple to identify any discrepancies or unrecognized transactions.

- Categorization of Transactions: Automatically categorize your transactions to see how your spending is distributed across different categories, such as groceries, dining, or entertainment.

- Personalized Spending Insights: Gain valuable insights into your spending patterns, helping you make informed decisions about your finances and identify areas where you can save.

Additional Security Measures Available Through Mobile Apps

In addition to tracking your debit card transactions, mobile apps provide additional security measures to safeguard your finances. Here are some features that enhance the security of your Pnc debit card:

- Two-Factor Authentication: Set up an extra layer of security by enabling two-factor authentication, which requires you to provide a unique verification code in addition to your login credentials.

- Card Controls: Temporarily block or unblock your debit card in case it is misplaced, giving you peace of mind knowing that unauthorized transactions will be prevented.

- Lost/Stolen Card Reporting: Quickly report a lost or stolen debit card through the app, allowing Pnc to take immediate action to protect your account and issue a replacement card if necessary.

- Biometric Authentication: Enable biometric authentication, such as fingerprint or facial recognition, to ensure that only you can access your mobile banking app.

- Secure Messaging: Communicate securely with Pnc customer service representatives through the app, addressing any concerns or inquiries without compromising your personal information.

By utilizing the Pnc mobile banking app, you can easily track your debit card transactions, manage your finances, and benefit from additional security measures. Stay connected to your finances wherever you go, ensuring peace of mind and control over your financial well-being.

Reporting Lost Or Stolen Pnc Debit Cards

If your Pnc debit card is lost or stolen, you can easily track it by reporting it to Pnc. They offer a simple process to protect your account and prevent unauthorized transactions. Just contact their customer service and provide the necessary details to get your card blocked and replaced promptly.

Immediate Steps To Take When Your Debit Card Goes Missing:

- Contact your bank: Call Pnc customer service immediately to report the loss or theft of your debit card. Acting promptly can help protect you from fraudulent charges.

- Freeze your card: If you have online banking, log in and freeze your Pnc debit card to prevent any unauthorized transactions.

- Check recent transactions: While on the phone with customer service, ask them to review your recent transactions and report any suspicious activity.

- File a police report: If you suspect your card was stolen, it’s a good idea to file a police report. This can provide evidence of the theft and help you further protect your identity.

- Monitor your accounts: Keep a close eye on your other bank accounts and credit cards to ensure no unauthorized activity is taking place.

Contacting Pnc Customer Service To Report The Loss:

- Call Pnc customer service: Dial the toll-free number provided by Pnc for reporting lost or stolen debit cards. This will connect you to their customer service department.

- Provide necessary details: Be prepared to provide your account information, such as your name, account number, and any other identification requested by the customer service representative.

- Follow instructions: Listen carefully to the instructions given by the representative. They will guide you through the process of reporting the loss of your debit card and will provide further guidance on next steps.

- Request a replacement card: Inform the customer service representative that you need a replacement card and inquire about the timeline for receiving it. They will provide you with the necessary information.

Understanding The Liability Protection Offered By Pnc:

- Zero liability protection: Pnc offers zero liability protection, which means you won’t be held responsible for any unauthorized transactions made on your lost or stolen debit card after you report it. This can provide peace of mind in case of fraudulent activity.

- Time limit for reporting: Pnc has a time limit for reporting lost or stolen cards to qualify for zero liability protection. It is crucial to act quickly to ensure you are eligible for this protection.

- Verified by Visa: Pnc also provides an additional layer of security through Verified by Visa. This service adds an extra step to the online checkout process, minimizing the risk of unauthorized card usage.

- Monitoring for suspicious activity: Pnc has robust systems in place to monitor your account for any unusual activity. If they detect any suspicious transactions, they will notify you promptly to take appropriate action.

Remember, it’s crucial to report the loss or theft of your debit card as soon as possible to minimize the risk of unauthorized transactions and protect your finances. By following these steps and taking advantage of Pnc’s liability protection, you can ensure your peace of mind and financial security.

Monitoring Pnc Debit Card Balance And Spending

Track your Pnc debit card balance and spending with ease. Stay in control and keep tabs on your transactions effortlessly.

Checking Your Available Balance Online Or Through Mobile Apps:

- You can conveniently monitor your PNC debit card balance in real-time by using PNC’s online banking portal or mobile apps.

- Instantly check your available balance at any time through the user-friendly digital platforms provided by PNC.

- Access your account details quickly and securely via the PNC website or mobile apps for a hassle-free experience.

- Stay updated on your account balance to ensure you have sufficient funds for your transactions.

- Manage your finances efficiently and track your spending habits with easy access to your PNC debit card balance.

Tracking Expenditures And Budgeting With Spending Analysis Tools:

- PNC offers useful spending analysis tools to help you track and categorize your expenditures effortlessly.

- Utilize PNC’s spending analysis tools to gain insights into your spending patterns and identify areas where you can make adjustments.

- Closely monitor your expenses by categorizing them into different categories such as groceries, dining out, entertainment, and more.

- Easily set and track your budget goals using PNC’s spending analysis tools to stay on top of your financial management.

- Implementing budgeting techniques and regularly reviewing your spending habits can contribute to better financial well-being.

Remember, staying aware of your PNC debit card balance and effectively tracking your expenditures can help you maintain financial control and make informed decisions. Explore the available digital tools from PNC to simplify your financial management and achieve your budgeting goals.

Frequently Asked Questions (Faqs) – Not Part Of Outline, This Is Here Only For The Ai Assistance To Understand

Looking to track your PNC debit card? Easily keep tabs on your card by logging into your PNC online banking account and navigating to the “Manage Cards” section. Follow the prompts to access card information and track its usage effortlessly.

How Long Does It Take For Pnc To Notify About Unauthorized Transactions?

- Pnc takes prompt action when it comes to notifying customers about unauthorized transactions. Here’s what you need to know:

- Timely Notification: Pnc aims to notify customers about unauthorized transactions as soon as possible.

- Real-time Alerts: If you have set up real-time transaction alerts, you may receive immediate notifications of suspicious activities.

- Fraud Detection Systems: Pnc employs advanced fraud detection systems that can quickly identify potential unauthorized transactions.

- Investigation Period: Once you report a suspicious transaction, Pnc will initiate an investigation. The time taken to complete the investigation may vary depending on various factors.

It is important to note that while Pnc strives to notify customers promptly, it is equally crucial for you to diligently review your account activity and report any unauthorized transactions in a timely manner.

Can I Track My Pnc Debit Card Without An Online Banking Account?

Yes! Even if you do not have an online banking account, you can still track your Pnc debit card. Here are a few simple ways to stay updated:

- Phone Banking: Pnc offers phone banking services where you can call their customer service hotline to inquire about your debit card transactions, balance, or any other related information.

- ATM Balance Inquiries: Visit a Pnc ATM and check the balance on your debit card. While this may not provide detailed transaction history, it allows you to stay informed about the available balance.

- Paper Statements: If you prefer physical records, Pnc sends monthly paper statements that provide a comprehensive overview of your debit card transactions and balance.

By utilizing these alternative methods, you can conveniently keep track of your Pnc debit card activity without an online banking account.

What Should I Do If I Suspect Fraudulent Activity On My Pnc Debit Card?

Discovering fraudulent activity can be alarming, but Pnc has measures in place to help you address the situation promptly and effectively. If you suspect any unauthorized transactions on your Pnc debit card, follow these steps:

- 1. Contact Pnc: Immediately get in touch with Pnc’s customer service to report the suspicious activity. They will guide you through the next steps and advise you on the necessary actions.

- 2. Freeze/Block your Card: Ask Pnc to freeze or block your debit card temporarily to prevent any further unauthorized transactions.

- 3. Initiate a Dispute: Pnc will guide you through the process of initiating a dispute for the fraudulent transactions. They may require you to provide specific details regarding the unauthorized charges.

- 4. Monitor Account Activity: Regularly monitor your account for any additional suspicious transactions. Report them to Pnc immediately.

- 5. Update Security Measures: Review your online banking password and consider changing it to ensure the security of your account. Pnc may also guide you on additional security measures you can take.

By taking prompt action and closely cooperating with Pnc, you can minimize the impact and resolve any fraudulent activity swiftly. Remember, Pnc is committed to safeguarding your finances and will provide the necessary support through the process.

Frequently Asked Questions On How To Track Pnc Debit Card

Can I Track My Pnc Card In The Mail?

Yes, you can track your PNC card in the mail. Just visit the PNC website and use their tracking service.

Can I Track My Mailed Debit Card?

Yes, you can track your mailed debit card.

How Can I Check My Pnc Debit Card Status?

To check your PNC debit card status, visit the PNC website or call PNC customer service.

How Long Do Pnc Debit Cards Take To Ship?

PNC debit cards typically arrive within 7-10 business days after applying.

Conclusion

To sum up, tracking your PNC debit card is essential for keeping track of your finances and ensuring the security of your transactions. By following the steps outlined in this blog post, you can easily monitor your card’s activity and promptly detect any unauthorized transactions.

Remember to regularly review your account statements, set up notifications for any suspicious activity, and report any discrepancies to your bank immediately. Utilizing online banking tools and mobile apps provided by PNC can also greatly simplify the tracking process. Whether you’re looking to track your expenditures, monitor your balance, or protect your financial well-being, effectively tracking your PNC debit card is crucial.

Stay vigilant and take advantage of the available resources to ensure a safe and secure banking experience.

- What Is the 11 Hour Limit: A Comprehensive Guide - June 7, 2024

- What Happens if You Drive on a Suspended License in Virginia - June 7, 2024

- Wilcox Justice Court Overview: Online Services & Legal Proceedings - June 6, 2024