To track an RBI complaint, visit the official website of the Reserve Bank of India (RBI) and navigate to the complaint tracking section. Are you facing an issue with a financial institution regulated by the Reserve Bank of India (RBI) and want to track your complaint?

The RBI provides a convenient and efficient way to track complaints through their official website. By visiting the complaint tracking section on the RBI website, you can easily monitor the progress and status of your complaint. This service allows individuals to stay updated on the resolution process and ensures transparency in addressing consumer grievances.

By following the simple steps outlined on the RBI website, you can easily track your complaint and stay informed throughout the resolution process.

Credit: www.moneycontrol.com

Understanding The Role Of Rbi Complaint Tracking

Understanding the role of RBI complaint tracking is crucial in knowing how to track RBI complaints efficiently. This process allows individuals to easily monitor and resolve their complaints with the Reserve Bank of India, ensuring better financial protection and consumer satisfaction.

RBI Complaint Tracking is a vital tool that plays a significant role in ensuring accountability and transparency within the banking sector. By implementing robust tracking mechanisms, the Reserve Bank of India (RBI) strives to enhance customer satisfaction and provide efficient resolution of complaints.

With the objective of improving the overall banking experience, RBI Complaint Tracking serves as a bridge between customers and the banking system. Let’s delve deeper into the various aspects of RBI Complaint Tracking:

Rbi Complaint Tracking As A Tool For Accountability And Transparency:

- Accountability: Complaint tracking holds the banking institutions responsible for addressing and resolving customer complaints promptly. It sets a benchmark for the banks to ensure that every complaint receives due attention, and appropriate actions are taken to resolve them effectively.

- Transparency: The tracking mechanism ensures transparency by providing customers with real-time updates on the progress of their complaints. With this information readily available, customers gain trust in the system and can track the status of their grievances, providing them with a sense of security.

Ensuring Efficient Resolution Of Complaints Through Tracking Mechanisms:

- Streamlined process: By tracking complaints, RBI ensures that the resolution process is streamlined, minimizing delays and confusion. The tracking system simplifies the entire complaint redressal journey, making it easier for customers to understand how their grievances are being addressed.

- Timely updates: Tracking mechanisms enable timely updates to customers regarding the progress of their complaints. This allows customers to stay informed about the actions being taken, ensuring they have a clear idea of when to expect resolution.

- Improved communication: With a complaint tracking system in place, effective communication between the customer, banking institution, and RBI is facilitated. Regular updates and communication regarding the complaint ensure clarity and transparency, fostering trust between all parties involved.

- Resolution monitoring: The tracking system allows the RBI to monitor the resolution of complaints across various banks. This monitoring enables the identification of common issues faced by customers and helps in implementing necessary interventions to rectify these issues on a system-wide level.

Understanding the role of RBI Complaint Tracking enhances the customer’s confidence in the banking sector while promoting transparency, accountability, and efficient resolution of complaints. Through continuous monitoring and improvement, RBI ensures that the grievance redressal process remains customer-centric and aligned with their needs.

Steps To Track Rbi Complaints

Track RBI complaints easily by following these simple steps. Visit the RBI website, access the Grievance Redressal Mechanism, file a complaint online, and track its progress using your unique complaint number. Stay informed about the status of your complaint effortlessly.

To ensure your RBI complaint is handled efficiently, it is crucial to track its progress. By following these simple steps, you can monitor your complaint and stay informed about its resolution status.

Registering A Complaint With The Rbi

To track your RBI complaint, you first need to register it with the RBI. Keep the following points in mind while registering your complaint:

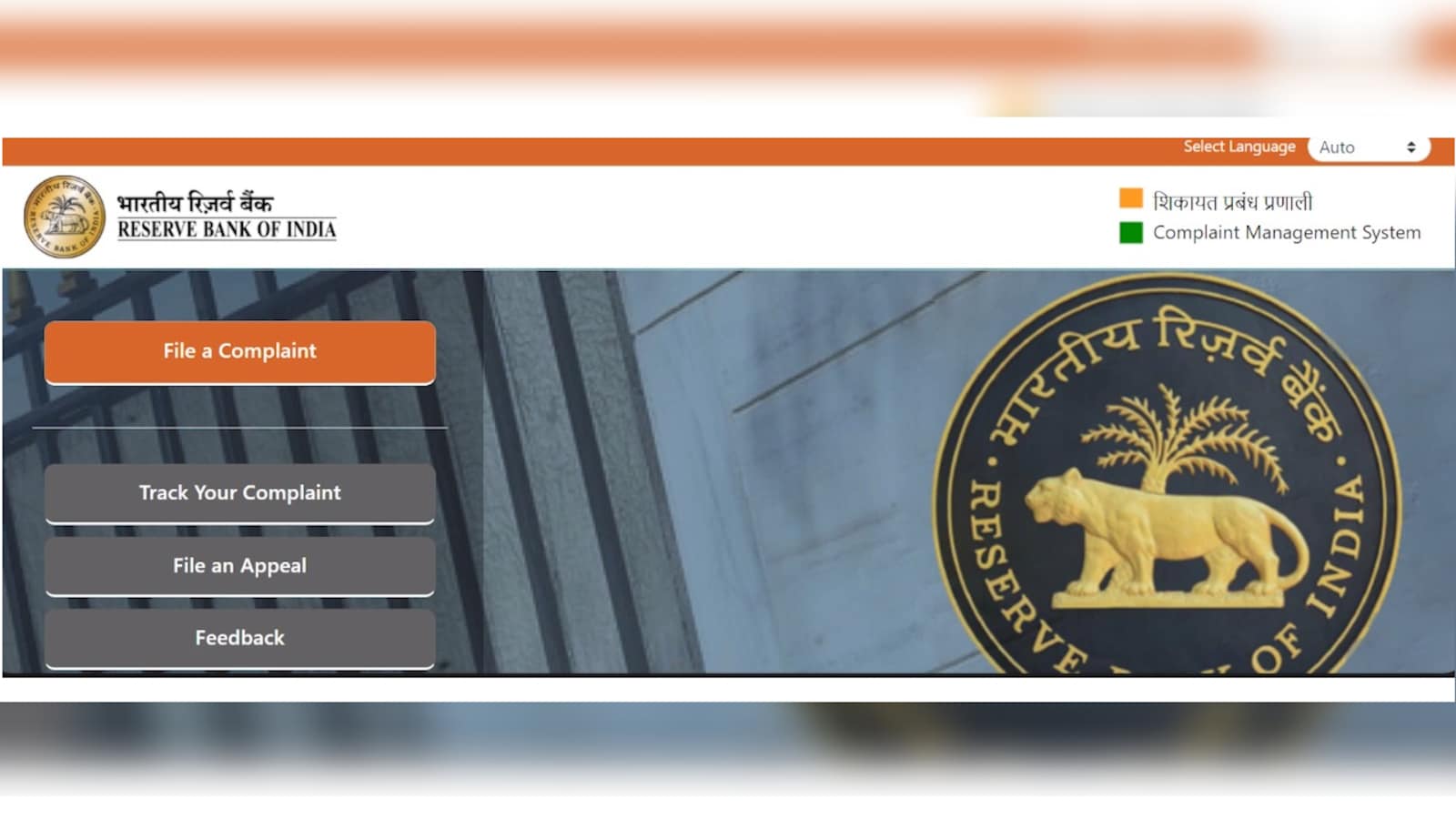

- Visit the official website of the RBI and locate the complaint portal.

- Look for a dedicated section or link for registering complaints.

- Provide all the necessary details accurately, including your contact information, the nature of the complaint, and any supporting documents.

How To Locate The Rbi Complaint Portal

Once you reach the RBI’s official website, follow these steps to locate the complaint portal:

- Look for a tab or menu option labeled “Complaints” or “Customer Support.”

- Click on the link to access the complaint portal.

- You may be redirected to a separate page or form specifically designed for registering complaints.

Filling Out The Complaint Form Accurately

To ensure your complaint is properly documented, it is essential to complete the complaint form accurately. Pay attention to the following details:

- Fill in all the required fields marked with asterisks.

- Provide a clear and concise description of your complaint in the designated text box.

- Attach any relevant documents or evidence to support your complaint if necessary.

Tracking The Progress Of The Complaint

After registering your complaint, you can start tracking its progress. Here’s how:

- Access the RBI complaint tracking system using your unique complaint reference number.

- Visit the complaint status page on the RBI website.

- Enter your reference number and any additional required information to view the current status of your complaint.

Understanding The Different Stages Of Complaint Resolution

Complaint resolution typically involves multiple stages. Familiarize yourself with these stages to better understand the complaint’s progress:

- Acknowledgement: Once your complaint is registered, the RBI will send an acknowledgement to verify receipt.

- Investigation: The RBI will investigate your complaint and gather necessary information to address the issue.

- Resolution: Based on the investigation, the RBI will propose a resolution or take appropriate action.

Monitoring Updates And Status Changes

Keep a close eye on any updates or status changes regarding your complaint. This can be done through the RBI’s complaint tracking system or by regularly checking your registered email for notifications. Be sure to:

- Login to the RBI complaint tracking system periodically to view any updates.

- Check your registered email for updates from the RBI, ensuring that you don’t miss any important communication.

Contacting The Rbi For Updates

If you seek additional information or wish to inquire about the progress of your complaint, you can reach out to the RBI using the following methods:

- Helpline: Contact the RBI’s helpline or customer support number provided on their website for further assistance.

- Email: Send an email to the RBI’s designated email address for complaint-related queries.

Utilizing The Rbi Helpline And Email Address

When using the RBI helpline or email address, keep the following pointers in mind:

- Prepare your unique complaint reference number and other relevant details before contacting the helpline or sending an email.

- Clearly explain your query or request for an update regarding your complaint.

- Polite and professional communication is essential when interacting with RBI representatives.

Following Up On The Complaint

To ensure your complaint receives the attention it deserves, consider following up with the RBI if necessary:

- If you do not receive any response or updates within a reasonable period, you can follow up using the same helpline or email address.

- Politely request the RBI to provide an update on the progress of your complaint and any expected timelines for resolution.

By following these steps and consistently tracking your RBI complaint, you can stay informed and actively participate in the resolution process. Remember to remain patient and document all interactions for future reference.

Best Practices For Effective Rbi Complaint Tracking

Learn the best practices for effectively tracking RBI complaints to streamline your complaint resolution process and improve customer satisfaction. Stay organized, monitor progress, and ensure prompt resolution with a robust complaint tracking system.

Keeping detailed records of the complaint:

- Maintain a comprehensive record of the complaint, including the date, time, and nature of the issue.

- Note down any relevant details, such as the name of the RBI representative involved and any reference numbers provided.

Documenting all interactions with the RBI:

- Document every interaction you have with the RBI regarding your complaint.

- Include details of phone conversations, emails, and any other forms of communication.

Storing relevant documents and correspondence:

- Keep all relevant documents and correspondence related to your complaint in a secure and organized manner.

- This includes copies of emails, letters, receipts, or any other evidence you may have.

Utilizing technology for efficient tracking:

- Take advantage of technology tools such as spreadsheets or tracking software to streamline and monitor your RBI complaint.

- Use these tools to record the progress and status of your complaint, notes from conversations, and any other relevant information.

Exploring mobile apps and online platforms:

- Consider using mobile apps or online platforms specifically designed for tracking and managing complaints.

- These platforms can help you stay organized, provide real-time updates, and enable easy access to all relevant information.

Setting up notifications and alerts for updates:

- Opt for notifications and alerts through email or mobile app notifications to stay informed about any updates or progress on your complaint.

- This ensures you don’t miss any important information or deadlines.

Seeking assistance from consumer forums:

- If you encounter challenges with tracking your RBI complaint, consider seeking assistance from consumer forums.

- Consumer forums can provide guidance, support, and advice on how to effectively track and escalate your complaint.

Understanding the role of consumer forums in resolving RBI complaints:

- Consumer forums play a crucial role in resolving RBI complaints by advocating for consumers’ rights and interests.

- They can provide legal knowledge, mediation services, and help escalate complaints to higher levels if necessary.

Leveraging their expertise and resources for tracking complaints:

- Consumer forums possess valuable expertise and resources in dealing with complaints against the RBI.

- Take advantage of their knowledge and support to ensure effective tracking and resolution of your complaint.

By implementing these best practices, you can ensure proper tracking of your RBI complaint, keeping detailed records, documenting interactions, utilizing technology, and seeking support when needed.

Advantages Of Tracking Rbi Complaints

Enhance your banking experience by tracking RBI complaints, gaining insights into your grievances and ensuring timely resolution for a seamless financial journey.

Keeping track of your RBI complaints can bring several benefits. By ensuring timely resolution of grievances, holding institutions accountable for their actions, and empowering consumers with information and updates, you can navigate the complaint process more effectively. Let’s delve deeper into these advantages:

Ensuring Timely Resolution Of Grievances

- Maintaining a record of your RBI complaints allows you to monitor the progress of your grievances and ensures that they are not overlooked or forgotten.

- By tracking your complaints, you can stay on top of any follow-up actions required and ensure that the concerned institution addresses your concerns promptly.

- Timely resolution of complaints eliminates unnecessary delays and frustrations, allowing you to move forward with peace of mind.

Holding Institutions Accountable For Their Actions

- Tracking RBI complaints enables you to hold institutions responsible for their actions, ensuring that they address your concerns and take appropriate measures to rectify the issue.

- Notifying institutions that you are closely monitoring the progress of your complaint can prompt them to take your concerns more seriously and prioritize their resolution.

- Holding institutions accountable helps promote a culture of transparency and accountability within the financial system, benefiting both individual consumers and the larger community.

Empowering Consumers With Information And Updates

- Keeping track of your RBI complaints empowers you with valuable information and updates throughout the complaint resolution process.

- By actively monitoring your complaints, you gain insights into the steps being taken by the concerned institution, allowing you to make informed decisions and take necessary actions.

- Staying updated on the progress of your complaint ensures that you are aware of any developments or additional requirements, enabling you to provide relevant information promptly.

Tracking RBI complaints comes with significant advantages. It ensures timely resolution, holds institutions accountable, and empowers consumers with information and updates. By actively monitoring your grievances, you can navigate the complaint process more effectively and work towards a satisfactory resolution.

Frequently Asked Questions For How To Track Rbi Complaint

How Do I Complain About Rbi Wrong Transaction?

To complain about a wrong transaction by RBI, follow these steps: 1. Contact your bank immediately. 2. Provide details of the transaction and explain the error. 3. Follow the bank’s complaint resolution process. 4. If unsatisfied, escalate the complaint to the RBI through their complaint management system.

How Do I Complain About Rbi Credit Report?

To complain about your RBI credit report, follow these steps: 1. Contact the Reserve Bank of India (RBI) directly. 2. Provide them with details of the issue and any supporting documents. 3. Follow their instructions for filing a formal complaint.

4. Keep track of communication and follow up for a resolution.

How Can I Track My Rbi Complaint?

To track your RBI complaint, visit the official RBI website and navigate to the complaint tracking page. Enter your unique complaint reference number and provide your personal details. The system will display the current status and updates on your complaint.

What Is The Rbi Complaint Registration Process?

To register an RBI complaint, you need to visit the RBI website and fill out the complaint form with accurate details. Provide specific information, such as transaction details and the nature of the complaint. Submit the form and note down the unique complaint reference number for tracking purposes.

Conclusion

Tracking RBI Complaints is a crucial aspect of ensuring accountability and transparency in the banking system. By following the steps outlined in this blog post, you can effectively track the progress of your complaint and ensure it receives the attention it deserves.

Start by gathering all relevant information and supporting documents. Then, submit your complaint through the appropriate channels, whether it’s online or offline. Stay vigilant and regularly follow up on the status of your complaint by contacting the relevant authorities. It’s important to remain patient throughout the process and provide any additional information when required.

Remember, tracking RBI complaints can not only lead to the resolution of your individual grievance but also contribute to the overall improvement in the banking system. So, take action today and hold financial institutions accountable for their actions.

- What Is the 11 Hour Limit: A Comprehensive Guide - June 7, 2024

- What Happens if You Drive on a Suspended License in Virginia - June 7, 2024

- Wilcox Justice Court Overview: Online Services & Legal Proceedings - June 6, 2024