To track RTGS UTR number online, use the official internet banking portal or mobile banking app of your bank. By logging in, you can easily find the transaction details and UTR number associated with your RTGS transfer.

RTGS (Real Time Gross Settlement) is a popular method used to electronically transfer funds between banks in India. Each RTGS transaction is assigned a unique identification number called the UTR (Unique Transaction Reference) number, which helps in tracking the status and details of the transfer.

If you want to track the UTR number of your RTGS transaction online, you can leverage the convenience of internet banking or mobile banking. This article will guide you on how to efficiently track the UTR number online using your banking portal or app.

Understanding Rtgs And Utr Numbers

RTGS and UTR numbers play a crucial role in tracking online transactions securely. With the convenience of online platforms, you can easily track your RTGS UTR number online to ensure the smooth completion of your transactions.

RTGS (Real-Time Gross Settlement) and UTR (Unique Transaction Reference) numbers are crucial components of the banking system that ensure secure and efficient fund transfers. By understanding what RTGS and UTR numbers are and the importance of tracking them online, you can have peace of mind and easily monitor your financial transactions.

What Is Rtgs?

RTGS is a real-time interbank payment system that allows businesses and individuals to transfer funds from one bank account to another on a real-time basis. This means that the money is transferred instantly and is settled individually, without being bundled with other transactions.

Here are some key points to know about RTGS:

- RTGS transactions have no minimum or maximum limit, making them suitable for both small and large payments.

- The system operates during banking hours, typically from 9 am to 4: 30 pm on weekdays and 9 am to 2 pm on Saturdays.

- RTGS transfers are secure and reliable, ensuring that your funds are transferred without any risk of fraud or errors.

What Is A Utr Number?

A UTR number, also known as a Unique Transaction Reference number, is a unique identification code assigned to each RTGS transaction. It serves as a reference to track and monitor the progress of your transfer. Here’s what you need to know about UTR numbers:

- Every RTGS transaction is assigned a UTR number, which acts as a digital receipt for your payment.

- You will receive the UTR number from your bank once the transaction is initiated.

- The UTR number can be used to verify the status of your payment, ensuring that it has been successfully processed.

Importance Of Tracking Utr Numbers Online

Tracking UTR numbers online allows you to stay informed about the progress of your RTGS transactions conveniently. Here are a few reasons why tracking UTR numbers online is essential:

- Verification: By tracking your UTR number online, you can easily verify whether your payment has been received by the recipient or if there are any discrepancies.

- Instant updates: Online tracking provides real-time updates on the status of your transaction, saving you time and effort in contacting your bank for information.

- Transparency: Tracking UTR numbers online offers transparency and visibility into the movement of your funds, ensuring that you have a clear record of your transactions.

- Financial control: By tracking your UTR numbers online, you can maintain better control over your finances and reconcile your bank statements more effectively.

Understanding RTGS and UTR numbers is crucial for managing and monitoring your financial transfers. By comprehending how these systems work and the benefits of tracking UTR numbers online, you can ensure smooth and secure transactions. Start using this knowledge to stay on top of your banking affairs and enjoy the convenience of online tracking.

Online Platforms For Tracking Rtgs Utr Number

Track and monitor your RTGS UTR number easily with online platforms. Access real-time updates and information on your transactions securely and conveniently. Simplify your tracking process with user-friendly interfaces and ensure smooth financial transactions.

If you’ve ever made an RTGS (Real Time Gross Settlement) transaction and need to track the UTR (Unique Transaction Reference) number, there are several online platforms available that can assist you. Whether you prefer using popular online banking platforms, government portals, or third-party websites, here are some options to consider:

Popular Online Banking Platforms:

- Bank of America: Bank of America offers an online platform where you can easily track your RTGS UTR number. Simply log in to your account and access the transaction history section. You should find the UTR number associated with each RTGS transaction listed there.

- Chase: Chase bank also provides a user-friendly online banking platform for tracking RTGS UTR numbers. Once you’re logged in, navigate to the transactions tab and search for the specific transaction you wish to track. The UTR number should be displayed alongside the transaction details.

- Wells Fargo: Wells Fargo customers can conveniently track their RTGS UTR numbers through the bank’s online banking platform. After logging in, go to the account summary and select the transaction history option. Look for the transaction you’re interested in, and the corresponding UTR number will be provided.

Government Portals For Tracking Rtgs Utr Numbers:

- Reserve Bank of India (RBI): The RBI offers a dedicated portal where individuals can track their RTGS UTR numbers. Access the RBI’s website and navigate to the section specifically designed for tracking RTGS transactions. Provide the necessary details, such as the transaction date and remitter details, to retrieve the UTR number associated with your transaction.

- HM Revenue and Customs (HMRC): In the United Kingdom, the HMRC website offers a platform for tracking RTGS UTR numbers. Visit the HMRC website and search for the section related to RTGS transactions. Follow the instructions provided, including entering the relevant transaction details, to access the UTR number you need.

Third-Party Websites For Tracking Utr Numbers:

- UTRTracking.com: UTRTracking.com is a reliable third-party website that specializes in tracking UTR numbers for RTGS transactions. Simply visit the website and enter the required transaction details. The platform will search its database and provide you with the UTR number associated with your transaction.

- Bankifsccodes.com: Bankifsccodes.com is another popular third-party website that offers a UTR tracking service. Navigate to the website and search for the RTGS tracking section. Enter the appropriate transaction information, and the website will retrieve the UTR number linked to your transaction.

Remember, when using these online platforms to track your RTGS UTR number, ensure that you have all the necessary transaction details readily available. This will help in obtaining accurate and up-to-date information.

Steps To Track Rtgs Utr Number Online

Learn how to track RTGS UTR number online in a few simple steps and stay on top of your financial transactions. Easily monitor your RTGS UTR number and ensure smooth money transfers with this convenient online tracking method.

To track an RTGS (Real-Time Gross Settlement) UTR (Unique Transaction Reference) number online, follow these simple steps:

Step 1: Accessing The Online Platform

- Visit the official website of your bank or the bank through which the transaction was made.

- Look for the option to track RTGS transactions or UTR number.

- Click on the relevant link to access the tracking platform.

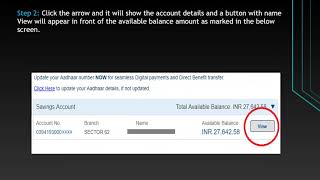

Step 2: Providing Necessary Details

- Enter your login credentials, such as username and password, to access your account.

- If you don’t have an account, you may need to register or provide other identification details to proceed.

- Follow the instructions prompted on the screen.

Step 3: Verifying Your Identity

- Once you have accessed the tracking platform, the system may require you to verify your identity for security purposes.

- This may involve providing additional personal information or answering security questions.

Step 4: Entering The Transaction Details

- After verifying your identity, locate the tab or section where you can enter the transaction details.

- Fill in the required fields with information such as the beneficiary’s account number, transaction amount, and date.

- Make sure the details you enter are accurate to ensure accurate tracking.

Step 5: Retrieving The Utr Number

- Once you have entered the transaction details, the system will display the UTR number associated with the transaction.

- Take note of this UTR number as it will be essential for tracking the status of your transaction.

Step 6: Tracking The Utr Number Status

- After retrieving the UTR number, navigate to the appropriate section of the tracking platform to track the status.

- Enter the UTR number in the designated field and click on the “Track” or “Submit” button.

- The system will then provide you with the current status of your transaction, such as “In process,” “Completed,” or “Failed.”

Tracking an RTGS UTR number online is a convenient way to stay updated on the status of your financial transactions. By following these simple steps, you can ensure a seamless tracking experience without the hassle of visiting the bank in person.

Now that you know the process, tracking your RTGS UTR number online should be a breeze. Take advantage of the convenience offered by online platforms and stay informed about your transactions.

Tips And Best Practices For Tracking Rtgs Utr Number Online

Learn effective tips and best practices to conveniently track RTGS UTR numbers online. Stay updated with the latest methods for tracking your transactions effortlessly using online platforms.

Tracking the Real Time Gross Settlement (RTGS) Unique Transaction Reference (UTR) number online can be a convenient way to stay informed about your transactions. Ensuring accuracy of input details, monitoring the status regularly, and contacting the bank for assistance are key practices that can help you effectively track your RTGS UTR number online.

Let’s delve into each of these tips further:

Ensuring Accuracy Of Input Details:

- Double-check the RTGS UTR number: Take care to accurately enter the RTGS UTR number provided to you. Even a single digit error can lead to the wrong transaction being tracked.

- Verify beneficiary account details: Ensure that you have entered the correct beneficiary account number and other relevant details. Any discrepancies might result in difficulties while tracking the transaction.

Monitoring The Status Regularly:

- Visit the bank’s official website: Log in to the online banking portal or the designated RTGS tracking page on the bank’s website.

- Enter necessary details: Provide the required information, such as the RTGS UTR number, to track the status of your transaction.

- Check for updates: Regularly monitor the status updates provided on the tracking page. This will help you stay informed about the progress of your RTGS transaction.

Contacting The Bank For Assistance:

- Customer support helpline: In case of any queries or concerns, reach out to the bank’s customer support helpline. They can provide guidance and assistance regarding tracking your RTGS UTR number.

- Submitting a support ticket: If you face technical difficulties or are unable to track your RTGS transaction, consider submitting a support ticket through the bank’s online portal. This enables you to document your issue properly and seek prompt resolution.

By following these tips and best practices, you can ensure an accurate and hassle-free tracking experience for your RTGS UTR number. Stay proactive, monitor regularly, and don’t hesitate to seek assistance from your bank when needed.

Common Issues And Troubleshooting

Track your RTGS UTR number effortlessly with our online troubleshooting guide. Easily navigate common issues and find solutions to streamline your tracking process. Experience a seamless and efficient way to manage your transactions online.

If you are encountering any issues while trying to track an RTGS UTR number online, don’t worry! Here are some common problems you might face and troubleshooting tips to help you resolve them:

Utr Number Not Generated

- In some cases, the UTR number might not have been generated yet due to a delay in the transaction processing.

- Ensure that you have waited for the appropriate time frame, as different banks have different processing times. Typically, it takes a few hours or even a day for the UTR number to be generated.

- If it has been longer than expected, reach out to your bank’s customer support for assistance. They will be able to check the status of your transaction and help you with any issues you might be facing.

Utr Number Not Found On The Platform

- If you have received the UTR number from the sender but are unable to find it on the tracking platform, double-check that you have entered the correct details. Pay close attention to any alphanumeric characters and ensure there are no typos.

- Verify that you are using the correct online platform or banking portal for tracking the UTR number. Each bank might have its own system for tracking transactions.

- If the issue persists, contact your bank’s customer support for further assistance. They can help you locate the UTR number or provide alternative methods for tracking your transaction.

Transaction Details Not Matching

- If you notice discrepancies between the transaction details you have received and the information displayed on the tracking platform, there might be an issue with the data entered or the system itself.

- Double-check the accuracy of the transaction details you have provided for tracking. Ensure that the beneficiary’s account number, UTR number, and other relevant information are correct.

- If the transaction details still do not match, reach out to your bank’s customer support. They will investigate the issue and help you resolve any discrepancies.

Remember, it is normal to encounter occasional issues when tracking an RTGS UTR number online. By following the troubleshooting tips above and seeking assistance from your bank’s customer support, you can resolve these common problems and ensure a seamless tracking experience.

Credit: www.livemint.com

Frequently Asked Questions For How To Track Rtgs Utr Number Online

Can Rtgs Be Tracked?

Yes, RTGS can be tracked for easy monitoring and verification of fund transfers.

How Can I Check My Utr Number Online?

To check your UTR number online, visit the government’s HM Revenue and Customs website.

What Is The Utr Code For Rtgs?

The UTR code for RTGS is a unique reference number used for Real Time Gross Settlement.

Why My Rtgs Transfer Is Not Credited?

Your RTGS transfer may not be credited due to incorrect bank details or technical issues. Contact your bank for assistance.

Conclusion

Tracking RTGS UTR numbers online has never been easier. With the advancement of technology, individuals can now conveniently keep track of their RTGS transactions with just a few clicks. By following the step-by-step guide mentioned in this blog post, you can easily access the relevant websites or apps to obtain the necessary information.

This ensures transparency and enables you to monitor your transactions in a hassle-free manner. Furthermore, tracking your RTGS UTR number online provides you with peace of mind, as you can quickly identify any discrepancies or delays in your money transfers.

It is a valuable tool that empowers you to have complete control and visibility over your finances. So, why wait? Start tracking your RTGS UTR number online today and enhance your banking experience effortlessly.

- What Is the 11 Hour Limit: A Comprehensive Guide - June 7, 2024

- What Happens if You Drive on a Suspended License in Virginia - June 7, 2024

- Wilcox Justice Court Overview: Online Services & Legal Proceedings - June 6, 2024