To track a UPI transaction, you can use the transaction ID or VPA to check the status on your UPI app or by contacting customer support. Now let me provide you with a brief introduction to tracking UPI transactions.

With the increasing popularity of UPI (Unified Payments Interface) as a secure and convenient mode of digital payment in India, it’s essential to know how to track your UPI transactions. Whether you’re making payments, receiving money, or simply monitoring the status, tracking UPI transactions ensures transparency and peace of mind.

We will explore the various methods to track UPI transactions quickly and efficiently. By following these steps, you can easily stay updated on the progress of your UPI transactions and handle any discrepancies that may arise.

Credit: bankbooklet.com

Understanding Upi Transactions

Understanding UPI transactions is essential for tracking your payments. With easy-to-follow steps, you can easily monitor your UPI transactions and ensure a seamless digital payment experience.

What Is Upi?

- UPI, which stands for Unified Payments Interface, is a real-time payment system in India that allows users to instantly transfer money between different bank accounts.

- It was launched by the National Payments Corporation of India (NPCI) to simplify the process of digital transactions and promote a cashless economy.

- UPI provides a single platform for various banking services, making it convenient for users to make payments and manage their finances.

How Does Upi Work?

- UPI works through a mobile application, enabling users to link multiple bank accounts to a single app.

- To initiate an UPI transaction, users need to create a virtual payment address (VPA) linked to their bank account.

- The sender and receiver’s VPAs are used to complete the transaction, eliminating the need for sharing bank account details.

- UPI transactions can be done using different methods like a VPA, scanning QR codes, or entering the receiver’s mobile number and bank details.

- After verifying the transaction, funds are securely transferred from one bank account to another in real-time.

Benefits Of Using Upi For Transactions:

- Convenience: UPI offers a convenient way to make transactions by combining multiple banking services into a single app. Users can manage different bank accounts, make payments, and track transactions all in one place.

- Instantaneous transactions: With UPI, funds are transferred instantly between bank accounts, ensuring quick and seamless transactions.

- Security: UPI transactions are highly secure as they require authentication through PIN, fingerprint, or face recognition. This ensures that only authorized users can initiate and complete transactions.

- 24/7 availability: UPI services are available 24/7, allowing users to make transactions at any time, even during weekends and public holidays.

- Cost-effective: UPI transactions are typically free or have very low transaction charges, making them a cost-effective option for individuals and businesses.

- Widely accepted: UPI is accepted by a vast network of merchants, online platforms, and bill payment services, providing users with a wide range of options to make payments.

By leveraging the UPI platform, users can enjoy the benefits of seamless, secure, and convenient digital transactions in India. Whether it’s sending money to friends, paying bills, or shopping online, UPI simplifies the process and provides a reliable payment solution for all.

Tracking Upi Transactions

Track your UPI transactions easily with these simple steps. Stay informed about your payments without any hassle.

Importance Of Tracking Upi Transactions:

- UPI (Unified Payments Interface) has emerged as a popular and convenient way to make digital payments in India. To ensure smooth and secure transactions, it is crucial to keep track of your UPI activity. Here’s why tracking UPI transactions is important:

- Fraud prevention: By monitoring your UPI transactions regularly, you can quickly identify any suspicious activity or unauthorized payments. Early detection allows you to take immediate action, such as reporting fraudulent transactions to your bank or UPI service provider.

- Budget management: Tracking UPI transactions helps you keep a tab on your expenses. By reviewing your transaction history, you can gain insights into your spending patterns, identify unnecessary expenditures, and make necessary adjustments to manage your finances better.

- Dispute resolution: Sometimes, UPI transactions may fail or encounter issues. By tracking your transactions, you can easily identify failed or pending payments and take steps to resolve them. This might include contacting customer support or initiating a refund request.

- Financial accountability: By maintaining a record of your UPI transactions, you can ensure accuracy in financial reporting and accountability. It provides you with an organized and comprehensive view of your financial activities.

Available Methods To Track Upi Transactions:

- To track UPI transactions, you can utilize different methods and tools offered by UPI-enabled apps or banking services. Here are some common ways to track UPI transactions:

- Transaction history in UPI apps: Many UPI apps provide a transaction history section within their interface. This feature allows you to view and track all your UPI transactions, including successful and failed payments.

- Bank statements: You can check your bank statements to track UPI transactions. Banks usually provide a detailed overview of your account activity, mentioning the UPI transaction details, date, and amount.

- Notification alerts: UPI-enabled apps often send real-time notifications for each transaction. These alerts can help you track your UPI transactions as they occur. Ensure that you have enabled notifications for your UPI app to receive these alerts.

- UPI transaction IDs: Each UPI transaction is associated with a unique transaction ID. By saving or noting down this ID, you can easily track and cross-reference your transactions whenever needed.

- Customer support: If you face any discrepancies or need further assistance in tracking your UPI transactions, you can reach out to customer support provided by the UPI app or your bank. They can guide you on how to track specific transactions or resolve any transaction-related issues.

Remember, tracking UPI transactions ensures the security of your financial data, helps you manage your budget effectively, and enhances your overall financial management. Make use of the available methods mentioned above to stay updated and in control of your UPI transactions.

Step-By-Step Guide To Track Upi Transactions

Track your UPI transactions with this step-by-step guide, ensuring a hassle-free process. Stay on top of your digital payments with ease and confidence.

To track UPI transactions effectively, you can follow these step-by-step instructions:

Registering For Upi Transaction Tracking

- Open the mobile banking app: Begin by launching the mobile banking app provided by your bank. Ensure that the app is updated to its latest version for a smooth experience.

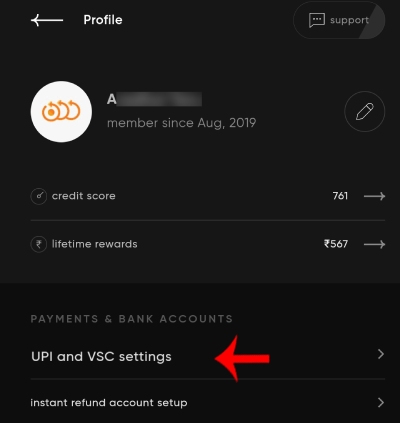

- Access UPI transaction tracking: Look for the UPI transaction tracking feature in the app’s menu. It may be labeled as “Transaction History,” “Payment Details,” or something similar.

- Log in to your account: Enter your credentials, such as your username and password, to log in to your bank account securely through the app.

- Navigate to UPI transactions: Once you have successfully logged in, locate the section that displays your recent UPI transactions. This section will have details like transaction amount, date, and beneficiary.

- View transaction history: Tap on the appropriate option to view the transaction history. The app may present different filtering options to help you find specific transactions or time periods.

- Understand the transaction details: Analyze the transaction details, such as the transaction ID, beneficiary name, transaction status, and date. These details will assist you in tracking your UPI transactions effectively.

Tracking Upi Transactions Through Mobile Banking Apps

- Open the mobile banking app: Launch the mobile banking app installed on your smartphone, ensuring you have the latest version.

- Find the UPI transaction tracking feature: Look for the feature in the app’s menu, often labeled as “UPI Transaction Tracking,” “Transaction History,” or similar.

- Log in securely: Use your credentials to log in to your bank account within the app. Ensure this information remains confidential.

- Access your transaction history: Once logged in, locate the section that displays your UPI transaction history. You will be able to see the transaction amount, date, beneficiary, and transaction status.

- Filter and search: Utilize the app’s filtering or search options to narrow down your UPI transactions by date range, transaction ID, or beneficiary name. This will help you track specific transactions more efficiently.

- Verify the transaction details: Review the transaction details provided, such as UPI reference numbers, to cross-check with your records. Note any discrepancies or unfamiliar transactions.

Using Upi Reference Numbers To Track Transactions

- Locate the UPI reference number: After initiating a UPI transaction, you will receive a UPI reference number. This is a unique alphanumeric code associated with your transaction and serves as an identifier.

- Note down the UPI reference number: Write down or save the UPI reference number immediately after the transaction. This will enable you to track the transaction later on.

- Open the mobile banking app: Launch the mobile banking app provided by your bank, ensuring it is up to date.

- Access UPI transaction tracking: Look for the section in the app that allows you to track UPI transactions. This may appear as “Transaction History” or “Payment Details.”

- Enter the UPI reference number: Enter the UPI reference number you previously noted down into the designated field.

- Track your transaction: Tap on the search or track button provided to proceed. The app will display the transaction details associated with the UPI reference number, including the status and other relevant information.

Remember, tracking your UPI transactions regularly through these methods helps you stay informed about your finances and detect any unauthorized transactions promptly.

Common Issues And Troubleshooting

Are you struggling to track your UPI transactions? Discover common issues and troubleshooting techniques to ensure smooth and hassle-free tracking of your transactions.

Unexpected Delays In Upi Transaction Tracking:

- UPI transactions are typically instantaneous, but there are situations when tracking may encounter unexpected delays. Here are some common causes and potential solutions:

- Slow network connectivity: Poor internet connection can hinder transaction tracking. Ensure you have a stable and fast network to minimize delays.

- Technical glitches: Sometimes, UPI platforms or banking systems experience technical issues that can delay transaction tracking. In such cases, it’s advisable to be patient and allow time for the systems to rectify the problem.

- Incorrect or incomplete details: If you enter incorrect UPI IDs or incomplete beneficiary details, the tracking process may encounter delays. Double-check the entered information to ensure accuracy.

- Server overload: During peak hours, UPI servers may become overloaded, leading to delays in transaction tracking. Consider initiating transactions during off-peak hours for better tracking speed.

- Third-party payment apps: When using third-party payment apps, delays may occur if they encounter technical problems or experience issues with their integration with UPI. Contact their customer support for assistance.

Failed Upi Transactions And Their Implications:

- Despite the convenience UPI offers, failed transactions can be frustrating. Understanding the causes and consequences of failed UPI transactions is crucial. Here are some important points to consider:

- Insufficient funds: If the sender’s account does not have sufficient funds, the UPI transaction will fail. Ensure there are enough funds in your account before initiating transactions.

- Incorrect UPI ID: Entering an incorrect UPI ID can result in a failed transaction. Verify the UPI ID of the recipient before initiating the transfer.

- Network issues: Poor network connectivity during the transaction process can lead to failure. Confirm your network connection is stable before proceeding with any UPI transaction.

- Expired payment links: Payment links shared by recipients have an expiration time. If you attempt to make a payment after the link has expired, the transaction will fail. Check the validity of the payment link before initiating the transaction.

- Bank restrictions: Some banks impose limits on UPI transactions, either in terms of the transaction amount or the number of transactions allowed per day. Ensure you are aware of any such restrictions imposed by your bank.

How To Resolve Discrepancies In Upi Transaction Records:

- Occasionally, discrepancies may arise in UPI transaction records. Here are some steps to help you resolve any issues you encounter:

- Check transaction status: Start by checking the transaction status on the UPI app or banking platform you used. This will provide you with the latest information on the transaction.

- Contact customer support: If you notice any discrepancies or have concerns about a particular transaction, reach out to the customer support of your bank or UPI app. They can provide insights and assistance in resolving the issue.

- Provide necessary details: When contacting customer support, ensure you provide all relevant details such as transaction IDs, UPI IDs, dates, and amounts involved. This information helps them investigate and address the issue effectively.

- Keep documentation: Maintain a record of transaction details, including reference numbers, receipts, and screenshots. These documents act as evidence if further investigation is required.

- Be patient: Resolving discrepancies may take time. It is important to remain patient during the resolution process and follow up with customer support as needed.

Remember, being aware of the common issues and troubleshooting steps related to UPI transaction tracking, failed transactions, and resolving discrepancies can help you navigate any challenges and ensure a smooth UPI transaction experience.

Best Practices For Efficient Upi Transaction Tracking

Track UPI transactions efficiently with these best practices. Learn how to easily monitor and manage your transactions without any hassle.

Tracking UPI transactions is crucial to ensure smooth financial operations. By effectively monitoring transaction reference numbers, transaction history, and utilizing UPI transaction status notifications, you can avoid errors, stay updated, and have a seamless transaction experience. Here are some best practices to efficiently track UPI transactions:

Keeping Track Of Transaction Reference Numbers:

- Note down the transaction reference number provided after completing each UPI transaction. This unique identifier helps in tracking and resolving any issues that may arise.

- Save the reference numbers in a secure location, such as a digital wallet or a dedicated file on your device, for easy access and retrieval.

- Organize the reference numbers chronologically to maintain a clear record of your UPI transactions.

- Cross-reference the reference numbers when verifying transaction details from your bank or payment provider.

Regularly Monitoring Upi Transaction History:

- Frequently check your UPI transaction history or log in to your UPI app to review your recent transactions.

- Pay attention to transaction dates, amounts, and recipient details to ensure accuracy and identify any suspicious activity.

- If you notice any discrepancies or unauthorized transactions, contact your bank or payment provider immediately to report the issue and take appropriate action.

Utilizing Upi Transaction Status Notifications:

- Enable transaction status notifications on your UPI app to receive alerts and updates regarding your transactions.

- These notifications can provide real-time information about successful transactions, pending transactions, or failed transactions.

- By staying informed through notifications, you can quickly identify any failed transactions and take necessary steps to rectify the issue, such as contacting the recipient or initiating a refund request.

Remember, efficient UPI transaction tracking helps you stay in control of your financial activities. By keeping track of reference numbers, monitoring transaction history, and taking advantage of transaction status notifications, you can ensure a secure and hassle-free UPI transaction experience.

Frequently Asked Questions On How To Track Upi Transaction

How Do I Track A Upi Transaction Id?

To track a UPI transaction ID, follow these steps: 1. Open your UPI app. 2. Go to the transaction history or transaction details section. 3. Enter the transaction ID in the search bar. 4. The app will display the status and details of the transaction.

Can Upi Payments Be Traced?

Yes, UPI payments can be traced for security and transparency purposes.

How Do I Track A Transaction With Reference Number?

To track a transaction with a reference number, use the provided reference number on the tracking platform.

Is Upi Reference Number And Transaction Id Same?

No, UPI reference number and transaction ID are not the same. They are two different identifiers for UPI transactions.

Conclusion

Tracking UPI transactions has become an essential skill in today’s digital era. With the increasing popularity of UPI as a payment mode, it is crucial to have a mechanism to monitor and manage these transactions effectively. By following the simple steps mentioned in this blog post, you can easily track your UPI transactions and stay updated on their status.

Utilizing the various UPI apps and online platforms available, you can conveniently access transaction history, view transaction details, and even receive notifications for successful payments. The ability to track UPI transactions ensures transparency and security, allowing you to keep a close eye on your finances.

So, next time you make a UPI transaction, remember to leverage the power of tracking to stay in control. With these tools and techniques, you can now confidently navigate the world of UPI payments with ease.

- What Is the 11 Hour Limit: A Comprehensive Guide - June 7, 2024

- What Happens if You Drive on a Suspended License in Virginia - June 7, 2024

- Wilcox Justice Court Overview: Online Services & Legal Proceedings - June 6, 2024