To track your UTR number in HDFC, you can use the HDFC Bank website or mobile app. Simply log in to your account, go to the ‘Accounts’ or ‘Transaction History’ section, and search for the UTR number associated with the transaction you want to track.

HDFC Bank, one of India’s leading banking institutions, offers a convenient way for customers to track UTR numbers. UTR, or Unique Transaction Reference, is a unique number assigned to every financial transaction for easy identification and tracking. Whether you’re a regular HDFC Bank account holder or conducting a one-time transaction, keeping track of your UTR number is essential.

With the advancement of technology, HDFC Bank has made it simple for customers to access their UTR numbers whenever needed. In this guide, we’ll explore the step-by-step process of tracking UTR numbers in HDFC Bank, both through their website and mobile app. By following these instructions, you can easily retrieve your UTR number and stay on top of your transactions.

Understanding Utr Number And Its Importance

Understanding the UTR number is crucial for tracking HDFC transactions effectively. Retrieve your UTR number by accessing your HDFC account online and navigating to the transaction details section. Stay informed and manage your financial transactions seamlessly with this key identifier.

What Is A Utr Number?

- A UTR (Unique Transaction Reference) number is a unique identifier assigned to every financial transaction conducted through HDFC Bank.

- It consists of a combination of letters and numbers that provide a specific reference to a particular transaction.

- The UTR number is generated by the bank and is used to track the transaction’s progress and ensure accuracy in financial records.

Why Is A Utr Number Important For Hdfc Transactions?

- Easy tracking: The UTR number allows individuals and businesses to track the progress of their financial transactions.

- Confirmation of payment: By providing the UTR number, customers receive confirmation that their payment has been successfully completed.

- Dispute resolution: In the event of any discrepancy or dispute, the UTR number serves as a vital piece of evidence to investigate and resolve the issue promptly.

- Financial record keeping: The UTR number acts as a unique identifier that aids in maintaining accurate financial records for both the bank and the customer.

- Reconciliation: It simplifies the reconciliation process by matching the UTR numbers with the corresponding transactions, ensuring the accuracy and completeness of financial statements.

Credit: ondemandint.com

Methods To Track Utr Number In Hdfc

Track your UTR number in HDFC easily by following these simple steps. Access the HDFC website, login to your account, go to the transaction history, and locate the UTR number for your desired transaction.

If you find yourself in need of tracking a UTR number for a transaction made through HDFC, there are a few methods you can utilize to retrieve this information. In this section, we will explore three methods: using the HDFC NetBanking portal, contacting HDFC customer support, and checking the HDFC transaction SMS or email.

Using The Hdfc Netbanking Portal:

- Logging in to your HDFC NetBanking account:

- Visit the HDFC Bank website and click on the “NetBanking” option.

- Enter your customer ID and password to log in to your account.

- Navigating to the transaction history:

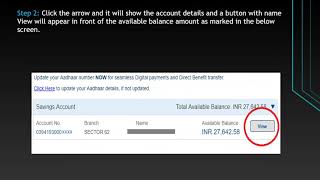

- Once logged in, locate and click on the “Accounts” section on the homepage.

- From the dropdown menu, select “Account Statement.”

- Locating the UTR number for a specific transaction:

- In the account statement, you will see a list of your recent transactions.

- Look for the specific transaction for which you need the UTR number.

Contacting Hdfc Customer Support:

- Dialing the HDFC customer support helpline:

- Use the customer support number provided by HDFC to contact them for assistance.

- Make sure to have your account details and relevant transaction information ready.

- Providing necessary details to the customer support representative:

- Once connected, explain your requirement of tracking the UTR number for a specific transaction.

- The representative will guide you through the process and may ask you for additional information.

- Requesting the UTR number for a specific transaction:

- Follow the instructions given by the customer support representative to request the UTR number.

- They will assist you in retrieving the UTR number for the transaction.

Checking The Hdfc Transaction Sms Or Email:

- Retrieving the transaction SMS or email from HDFC:

- Access your mobile phone’s SMS inbox or your email account associated with your HDFC banking profile.

- Look for the transaction-related message from HDFC.

- Identifying the UTR number within the transaction details:

- Open the transaction message and locate the relevant details.

- Search for the UTR number within the provided information.

These methods provide different avenues for obtaining the UTR number for a specific transaction made through HDFC. Choose the option that suits you best and retrieve the required information effortlessly.

Tips And Considerations For Tracking Utr Number In Hdfc

Find out how to easily track your UTR number in HDFC bank with our simple tips and considerations. Stay on top of your financial transactions and ensure smooth banking experience.

If you’ve made a transaction through HDFC and are waiting for the UTR (Unique Transaction Reference) number, it’s essential to stay informed and ensure a smooth tracking process. Tracking the UTR number can help you keep a record of your transaction, verify its accuracy, and provide it to relevant parties when needed.

Here are some valuable tips and considerations to assist you in the UTR number tracking process:

Checking For Delays In Utr Number Availability:

- Keep in mind that UTR numbers may not be available immediately after a transaction. It can take some time for the number to be generated and updated in the system. Patience is key during this period.

- Check for any potential delays caused by unforeseen circumstances such as technical glitches or high transaction volumes. These issues can impact UTR number availability, so it’s worth considering if you experience any delays.

- Stay updated with HDFC’s communication channels, as they might inform customers about any known delays in UTR number generation. This way, you’ll be aware of any ongoing issues and can plan accordingly.

The Importance Of Keeping Transaction Records For Future Reference:

- Maintaining a record of your transactions is crucial for future reference. It ensures you have the necessary information readily available if required for audits, tax purposes, or dispute resolution.

- Consider organizing your transaction records systematically so that they are easily accessible when you need them. You can use digital tools or create a filing system to keep track of transaction details, including UTR numbers.

- Having transaction records readily available can save you valuable time and effort in the long run. It allows for smoother financial management and provides a comprehensive overview of your financial activities.

Verifying The Accuracy Of The Utr Number Before Providing It To Third Parties:

- Before sharing the UTR number with any third parties, such as beneficiaries, business partners, or financial institutions, it’s crucial to verify its accuracy. Providing the wrong UTR number can lead to incorrect processing or complications.

- Double-check the UTR number against your transaction records to ensure it matches the intended transaction. Mistakenly providing an incorrect UTR number can result in discrepancies and potentially hinder transaction-related activities.

- Take the time to cross-reference the UTR number with any additional information related to the transaction, such as beneficiary details and transaction amounts. This extra step can help prevent any errors or misunderstandings down the line.

Remember, tracking the UTR number in HDFC requires attention to detail and a proactive approach. By following these tips and considerations, you can ensure a smooth tracking process, maintain accurate transaction records, and safeguard the integrity of the UTR number when sharing it with relevant parties.

Stay vigilant and organized, making the most out of HDFC’s services.

Frequently Asked Questions Of How To Track Utr Number In Hdfc

How Can I Check My Hdfc Utr Number?

To check your HDFC UTR number, follow these simple steps on the HDFC Bank website.

How Can I Track A Utr Number?

To track a UTR number, you can contact your bank or financial institution and provide them with the necessary information. They will be able to assist you in locating your UTR number.

How Do I Track The Status Of A Neft Transfer In Hdfc?

To track the status of a NEFT transfer in HDFC, follow these steps: 1. Log in to your HDFC Net Banking account. 2. Go to the ‘Funds Transfer’ section. 3. Click on ‘NEFT Transactions. ‘ 4. Select the relevant account and date range.

5. You will see the status of your NEFT transfers on the screen. Ensure that you have your login credentials ready to access your HDFC Net Banking account.

What Is Utr Number For Hdfc?

The UTR number for HDFC is a unique reference code used for tracking and identifying transactions with the bank.

Conclusion

Tracking your UTR number in HDFC is a crucial process that helps you monitor your financial transactions and stay in control of your funds. By following the steps outlined in this blog post, you can quickly and easily retrieve your UTR number from various sources such as your bank statement, mobile banking app, or HDFC customer care.

Keeping track of your UTR number is essential for verifying payments, tracking refunds, and resolving any payment-related issues. Remember to keep your UTR number secure and share it only with authorized parties to prevent any fraud or misuse. With the convenience of online banking, tracking your UTR number has become more accessible and user-friendly than ever before.

So, take advantage of these resources and stay informed about your financial transactions for a smooth and hassle-free banking experience.

- What Is the 11 Hour Limit: A Comprehensive Guide - June 7, 2024

- What Happens if You Drive on a Suspended License in Virginia - June 7, 2024

- Wilcox Justice Court Overview: Online Services & Legal Proceedings - June 6, 2024